How fundamental analysis is done?

Whenever we like to invest in share market, this question always comes to our mind, how to choose a share to invest. The beginners in stock market just open DMAT account and start trading without any knowledge of fundamental analysis. Here, we are mentioning , how a beginner or an experienced trader can choose to invest or trade in a stock.

The very first thing which comes to mind is company’s fundamental through its Balance sheet. But there is problem that many of the beginner traders dont know how to read the Balance Sheet correctly. Well you need not to be an accountant or C.A. to read the Balance Sheet.

Even if he knows how to read the balance sheet, it can not be said whether the Balance Sheet is manipulated or otherwise. In view of this problem, we have made Fundamental Analysis very Simple in Steps which are easy to understand.

LOOK FOR PRODUCT NOT SHARE

When ever we like to invest in a share, we must look at its product very first. For example, here we are taking two companies, (1) Maruti , car manufacturer leader ( 2) Minda Industries ( Auto Parts Business ). Now we see that Maruti is leader in its segment in India. There are about 50% market share in car auto industries of Maruti company. We see that the product of the company is also selling in India. But can we say that Maruti will remain leader in the future also?

The answer is “dont know” because we can not be sure about future. Any other company may become leader in the near future. Hence, the sale of the maruti will go down and so the profit, which will make the share go down from its current price. Here, the product is good but we are not sure about its future. Where we are not sure about the future of the company, we can not be sure of generating income from the share of the company.

On the other side, we are comparing Minda Industries which is in the auto parts business. We also know that Minda has good market image. It has a lot of auto parts in the market for many companies like Maruti, Hyundai, Tata etc. Can we say that in future the demand of the auto parts will remain or increase? The answer is yes, because we have seen there is a huge growth in auto sector. Transport is the key to the development. It doesnt matter for Minda Industries whether Maruti is leader or Hyundai or any other new company comes and become leader in car production and sales. The demand for the auto parts will remain in future and so the sale of the Minda Industries can remain stable.

One point is very necessary to note here that company doesnt sell its product, but its goodwill and trust. If you, the trader, want to invest in a share but you dont have trust in the product of the company, then never invest in such a company.

Now we will look at the share price of Maruti and Minda Industries together to see whether our “Product analysis” work or otherwise. Below is the Technical Chart of Maruti and Minda Industries :

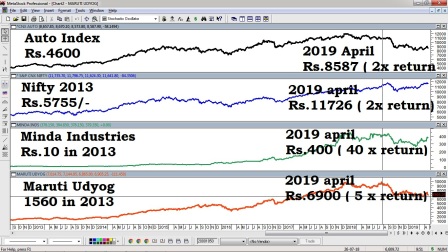

Now you can see above, the green line is the chart of Minda Industries. The rate of Minda Industries share was Rs.10 only in the year 2013 June. Whereas the Maruti rate was 1560 on the same date.

As we know , that market rallied up from 2013 to 2019 , Lets see what happened with others

In the above Picture we can that India Auto Index was Rs.4600 in 2013 ( June ) which grew to Rs.8587 in 2019 april. which is about double return in six years. Nifty also gave double return i.e. 5755 to 11726. Maruti udyog gave about 5 x return from Rs.1560 to Rs.6900/- as on 2019 april. But here we see Minda Industries, which gave extra ordinary return of 40 times, Means had you invested Rs.1 lac in Minda Industries , it would have been 40 lacs in just 6 years, this is the power of fundamental analysis and product analysis and how to choose a right share.

There are other example of product analysis which is a part of fundamental analysis. By now you must understood what is fundamental analysis?

Fundamental Analysis is the analysis of a company fundamental. Here fundamental means, the company product, its future demand, reliability, trust, sell, balance sheet, Debt to equity ration, PE Ratio and many more. You can see, that in this we just saw the product of the company, its reliability and trust and future demand stability.

So this was my try to make you understand that how much “Product Analysis” has importance in finding how to do Fundamental Analysis and how to choose a stock while investing.

Hope you like it, we are looking forward for your doubt and question also below :-